Amazon.com Inc. continues to prove its dominance in the tech and retail sectors with impressive financial growth in 2024. As the company diversifies beyond e-commerce, its performance in cloud computing and advertising is driving unprecedented gains in revenue and profitability.

https://vizhub.com/nitanagdeote/387e1d52969e49de94098118dce9eccd?mode=embed

🚀 Revenue and Income Surge

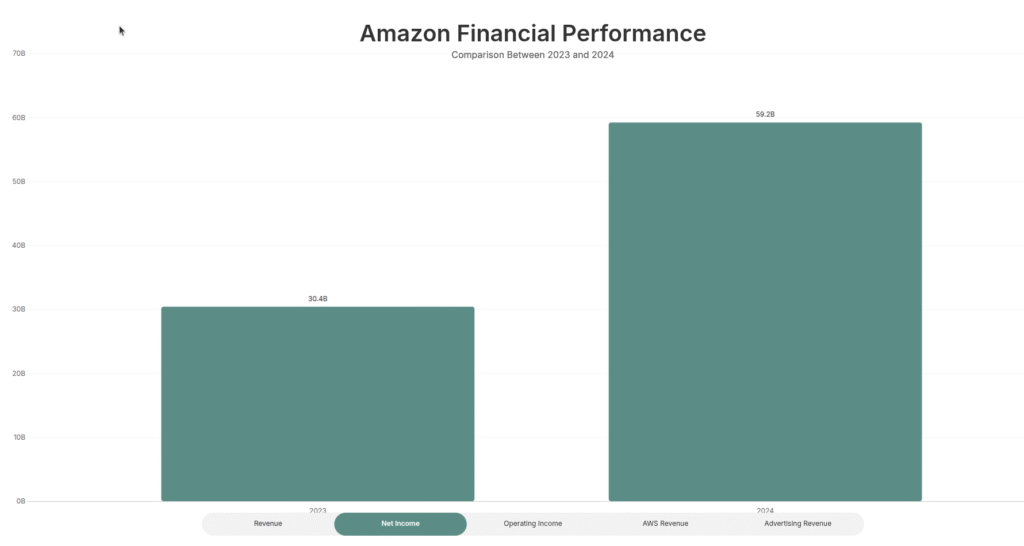

In 2024, Amazon reported total revenue of $638 billion, up from $574.8 billion in 2023—an 11% increase year-over-year. More striking, however, is the company’s net income, which nearly doubled from $30.4 billion in 2023 to $59.2 billion in 2024. This substantial leap in profitability signals not just higher sales but improved operational efficiency and profit margins.

⚙️ Operating Income Nearly Doubles

Operating income followed a similar trajectory, rising from $36.8 billion in 2023 to $68.6 billion in 2024. This indicates that Amazon is not only growing top-line revenue but is also managing its core operations more effectively. Investors often watch this metric closely, as it reflects the health of a company’s business model beyond temporary gains or losses.

☁️ Cloud Dominance with AWS

Amazon Web Services (AWS) remains a cornerstone of Amazon’s growth engine. In 2024, AWS brought in $107.6 billion in revenue, up from $90 billion in 2023. With high operating margins and growing global demand for cloud infrastructure, AWS continues to position Amazon as a major player in enterprise technology.

📢 Advertising Revenue on the Rise

Advertising is another fast-growing segment. Amazon’s ad revenue climbed from an estimated $37.7 billion in 2023 to $45 billion in 2024. With more businesses vying for visibility on the Amazon platform, this segment has become a lucrative and strategic asset, second only to AWS in its margin potential.

📊 Why This Matters

Amazon’s financial performance underscores its strategic pivot from a retail-first business to a diversified tech giant. The data shows a balanced mix of growth across segments, reduced dependence on retail, and strong investment in high-margin, scalable services.

For investors, analysts, and business leaders, these figures offer key insights into where the company—and the broader tech economy—is headed. With continued investment in AI, logistics, and infrastructure, Amazon is well-positioned to weather economic shifts and regulatory pressures.