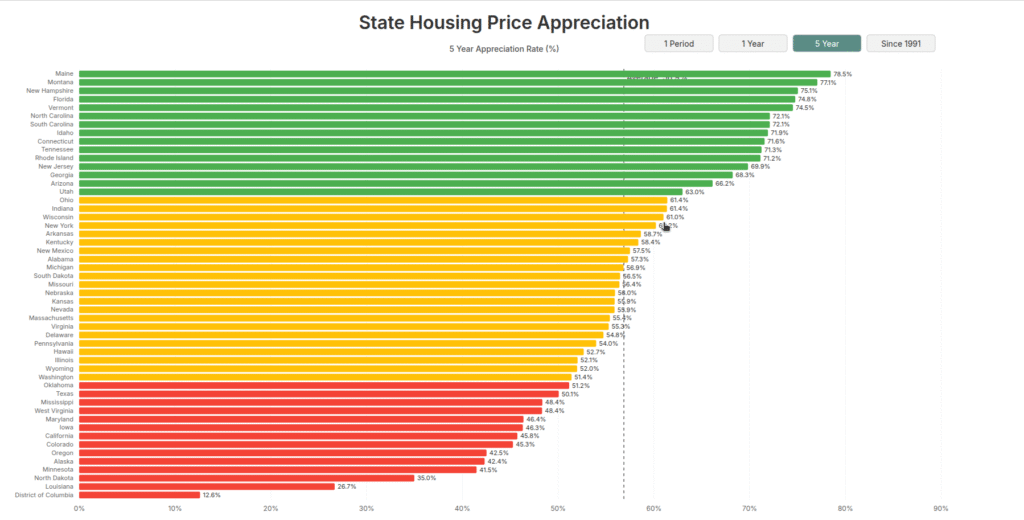

Understanding how housing prices have changed across the U.S. can help buyers, investors, and policymakers make smarter decisions. In this post, we explore a dynamic visualization that shows 5-year housing price appreciation rates for all 50 states—ranked and color-coded for clarity.

https://vizhub.com/nitanagdeote/e77d4607097e4a25b73097eede4ebb1e?mode=embed

📊 What the Visualization Shows

This interactive chart highlights:

The percentage increase in home prices over the past 5 years for each state

How each state compares to the national average

A ranking from highest to lowest appreciation, offering a quick view of regional trends

States with higher-than-average growth are marked with warm colors, while those below the national average are cooler-toned. This visual differentiation helps you instantly spot which states have led the market—and which have lagged.

🏆 Top Performing States

Some states have seen remarkable growth, driven by factors like economic migration, job growth, and housing supply constraints. If you’re looking to invest, relocate, or simply understand market behavior, these high-performing states deserve a closer look.

📉 Slower-Growth Regions

Other states show modest appreciation or even market stagnation. While this isn’t necessarily bad—it could mean more affordability or slower economic growth—it’s crucial context for both buyers and investors.

💡 Why Housing Appreciation Matters

For Homeowners: Appreciation increases equity and long-term wealth.

For Investors: It helps forecast ROI and potential rental value increases.

For Buyers: Timing your purchase in a rising or cooling market can save thousands.

🧭 How to Use This Visualization

Use this chart to:

Compare your state’s growth to others

Identify strong investment regions

Understand long-term housing trends shaping the U.S. market

📌 Tip: Hover over any bar to see the exact appreciation percentage.

📈 Data Sources & Methodology

This data is based on [insert data source, e.g., Federal Housing Finance Agency (FHFA)] and represents state-level housing price appreciation over 5-year periods. It reflects aggregated trends and may not capture local neighborhood-level variations.

🔗 Explore the Visualization Now

👉 View the Full Chart Here